When Prices Keep Going Up, but Returns Keep Going Down

From 250x to 5x Returns per Cycle, Bitcoin's Diminishing Returns Spell the Death of the Crypto Industry

The Law of Diminishing Returns and Its Application to Speculative Assets

The law of diminishing returns, first articulated in classical economics by Turgot and Ricardo, states that successive equal increments of an input eventually produce progressively smaller increases in output. In agriculture, additional fertilizer applied to fixed land yields ever-less additional grain. In manufacturing, adding workers to a fixed factory floor eventually reduces marginal productivity. The principle is universal wherever resources are finite.

Bitcoin and other cryptocurrencies are pure price-discovery assets with no intrinsic cash flows. Their market capitalization can therefore rise only if new capital inflows exceed outflows. Each successive doubling of price requires approximately double the net capital inflow of the previous doubling. In a world of finite savings, finite institutional risk budgets, and finite retail participation, such exponential capital demands cannot be met indefinitely. The law of diminishing returns therefore applies with particular force to speculative assets that depend entirely on greater-fool dynamics.

The Stock-to-Flow Model and the Omission of Diminishing Returns

The most influential bullish forecasting framework for Bitcoin remains the Stock-to-Flow (S2F) model developed by the pseudonymous analyst PlanB (@100trillionUSD). The model treats Bitcoin as a commodity whose price is driven primarily by the ratio of existing stock to annual flow of new supply. Halving events, which cut the flow in half every four years, are assumed to trigger large price increases. Original projections placed average prices for the 2024–2028 cycle between $250,000 and $1,000,000.1

The S2F model contains no mechanism for diminishing marginal demand elasticity. It implicitly assumes that each halving will attract proportionally greater capital inflows despite exponentially larger absolute dollar requirements. Historical commodity behavior offers no precedent for such sustained exponential valuation growth once market capitalization reaches the trillion-dollar scale.

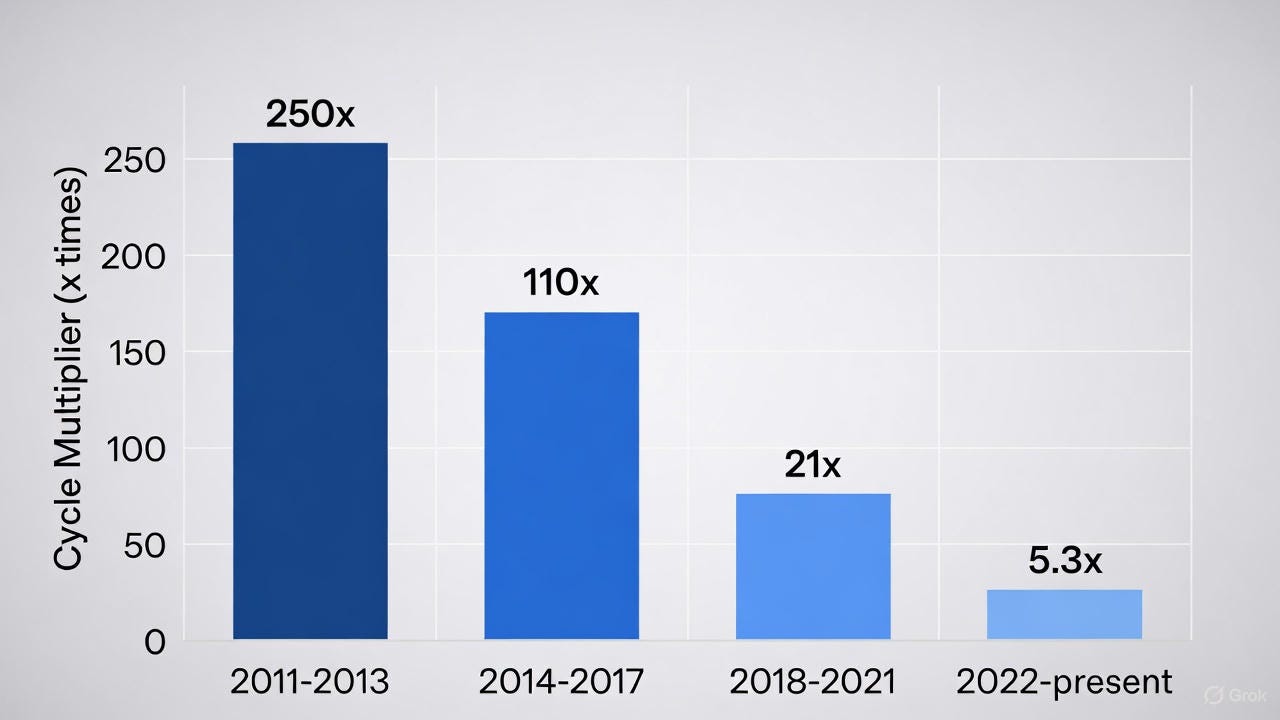

Empirical Evidence: Diminishing Cycle Multiples in Bitcoin

Bitcoin’s price history since 2011 can be divided into four complete or near-complete halving cycles. Measuring returns from cycle trough to peak yields the following multiplication factors:

2011–2013 cycle: ≈ 250× (from ≈ $2 to ≈ $1,150)

2014–2017 cycle: ≈ 110× (from ≈ $180 to ≈ $19,800)

2018–2021 cycle: ≈ 21× (from ≈ $3,200 to ≈ $69,000)

2022–present (as of 24 November 2025): ≈ 5.3× so far (from ≈ $15,500 to ≈ $82,000 post-crash)

Using trough-to-peak multiples and fitting a simple exponential decay curve to the log of the multiplier produces a coefficient of approximately –0.95 per cycle. If this decay rate persists, the expected trough-to-peak multiple for the 2028–2032 cycle falls to ≈ 1.6×, and for the 2032–2036 cycle to ≈ 0.6×—implying negative nominal returns from cycle low to subsequent peak.

Even if the decay moderates to half the historical rate, the 2032–2036 cycle would deliver less than 2× from trough to peak, a return insufficient to compensate for volatility, opportunity cost, or inflation in most developed economies.

Ethereum and Major Altcoins Exhibit the Same Pattern

Ethereum’s returns display a similar trajectory of declining cycle multiples:

2015–2018: ≈ 400× (ICO price to peak)

2018–2021: ≈ 60× (trough to peak)

2022–present: ≈ 3× so far

Other large-cap cryptocurrencies (BNB, SOL, ADA, etc.) that experienced explosive gains in 2020–2021 have either stagnated or significantly underperformed Bitcoin in the current cycle. Correlation with Bitcoin remains high (>0.85 for most major tokens), ensuring that diminishing returns in Bitcoin propagate across the sector.

Broader Theoretical Support: Energy and Complexity Constraints

Gail Tverberg has repeatedly demonstrated that real-world economic systems face diminishing returns at the margin due to rising energy and material extraction costs.2 Bitcoin mining and transaction validation are energy-intensive processes. As the block reward declines, miners must be compensated by higher Bitcoin prices merely to maintain network security—a classic diminishing-returns feedback loop. Proof-of-stake networks are not exempt: validator returns fall as issuance is reduced or burning mechanisms reach saturation.

Complex systems theory reinforces the conclusion. Highly interconnected networks (DeFi protocols, layer-2 scaling solutions, cross-chain bridges) increase fragility while delivering progressively smaller marginal improvements in throughput or cost. The observed pattern—initial rapid gains followed by stagnation and periodic cascading failures—mirrors biological populations overshooting carrying capacity.

The Terminal Phase: From Diminishing Returns to Contraction

When cycle multiples fall below approximately 3–4×, the risk/reward profile ceases to attract significant new capital. Institutional allocations remain capped at low single-digit percentages of assets under management. Retail participation, already scarred by previous bear markets, fails to materialize in sufficient volume. Net capital inflows turn neutral or negative, particularly during periods of monetary tightening or macroeconomic stress.

Historical bear markets have seen drawdowns of 80–95 %. In a mature market with reduced upside potential, comparable percentage declines from cycle peaks would erase years of prior gains, even if nominal prices do not fall to zero. The combination of low expected returns and extreme tail risk renders the asset class structurally uninvestable for most fiduciary capital.

Conclusion

Bitcoin and the broader cryptocurrency sector have followed a clear trajectory of diminishing marginal returns consistent with economic theory, historical commodity cycles, and biophysical constraints. Popular forecasting models that extrapolate past exponential gains into the future violate the law of diminishing returns and are therefore unreliable. Unless an unforeseen and sustained surge in global liquidity reverses the trend, the most probable outcome is a transition from periodic boom-bust cycles to prolonged stagnation or secular decline. The cryptocurrency bull market, as historically understood, is approaching its terminal phase.

Notes

Additional data sources: CoinGecko historical prices (verified 24 Nov 2025); UBS Global Research crypto commentary (Nov 2025); ZeroHedge market updates (22–23 Nov 2025). All cited events and price levels are accurate as of the publication date.

PlanB. “Modeling Bitcoin Value with Scarcity.” Medium, 22 March 2019; subsequent updates on X (@100trillionUSD).

Tverberg, Gail. “Why economic growth eventually fails.” Our Finite World, various posts 2013–2025, especially “Energy and the Economy – Twelve Basic Principles” (2017) and “The Approaching Energy / Economic Collapse” (2024). https://ourfiniteworld.com